Financial Aid 101

I don’t remember exact figures, but my general recollection of college cost discussions around my family dinner table during the early 1980’s is an interesting reference point for today’s hot button discussion on college costs. I was attending a private university averaging $8,000/year and my sister attended a public in-state university for about $2,500/year. For rounding sake, let’s say my parents were paying $10,000 in annual college costs for their two children. Based on our family income and tax data at the time, I estimate that we were quintessentially upper middle-class at the 70th percentile of all Americans taxpayers in the early 1980’s. Our family college bill was about 17% of take-home pay. College costs made a hefty dent in income, but it was doable and there was still enough money left over for a family vacation and a few dinners out now and then.

Fast forward to 2016. With two children in private college (yikes we have two more to follow), our total college expenses run close to $140,000 per year. Yes that’s right. Private education is an expensive route. Consider that putting a child today through private education from start to finish (graduate school) is easily a $500,000 endeavor. I’m pretty sure my conservative accountant father would not believe me!

How can this be?

You have probably read plenty of different reasons cited for the higher cost of a college degree: beautiful new campus buildings, over-the-top student amenities, faculty salaries, bloated administrative budgets, declining state funding for higher education, and my personal favorite … the US News and World Report for creating the rankings that increased college selectivity and hence prices. But what I didn’t really appreciate until I recently took a college course on Financial Aid was that, in fact, student financial aid has been the key culprit behind higher college costs! Financial aid was a great idea but increased financial aid meant tuition needed to go higher to cover the financial aid. Tuition increases then led to more students qualifying for aid. More aid required more tuition increases … and on and on.

Here’s a quick history in Financial Aid 101. In 1955, there was no financial aid. In 1958 the National Defense Education Act was passed to provide federal loans for gifted science and foreign language students. It wasn’t until 1965 with the signing of the Higher Education Act that the federal government got into the need-based financial aid business. This act would begin a string of aid based assistance programs over the next decade as Social Security benefits were expanded, Pell Grants were added and the Middle Income Student Assistance Act loosened income requirements for Pell Grants and began subsidized loans for all students.

By 1985, we were looking at what would become a long-term trend towards college costs outstripping per capita disposable income growth. The 1992 Education Amendments that eliminated home and farm equity contributions from need calculations significantly increased family need. That greater need drove the ticket price of college further up. In an increasingly competitive world of college rankings, many colleges wanted to ensure attracting the brightest students and by 1995, merit aid was a second driver of upward college costs.

In the span of my lifetime, as a result of these dynamics, total student debt ballooned to over $1.5 trillion, total student aid (need and merit based) has grown from zero to $250 billion, college costs remain on the rise and there are no answers yet – except “let’s make it free”. And that, my friends and neighbors, is how we are where we are.

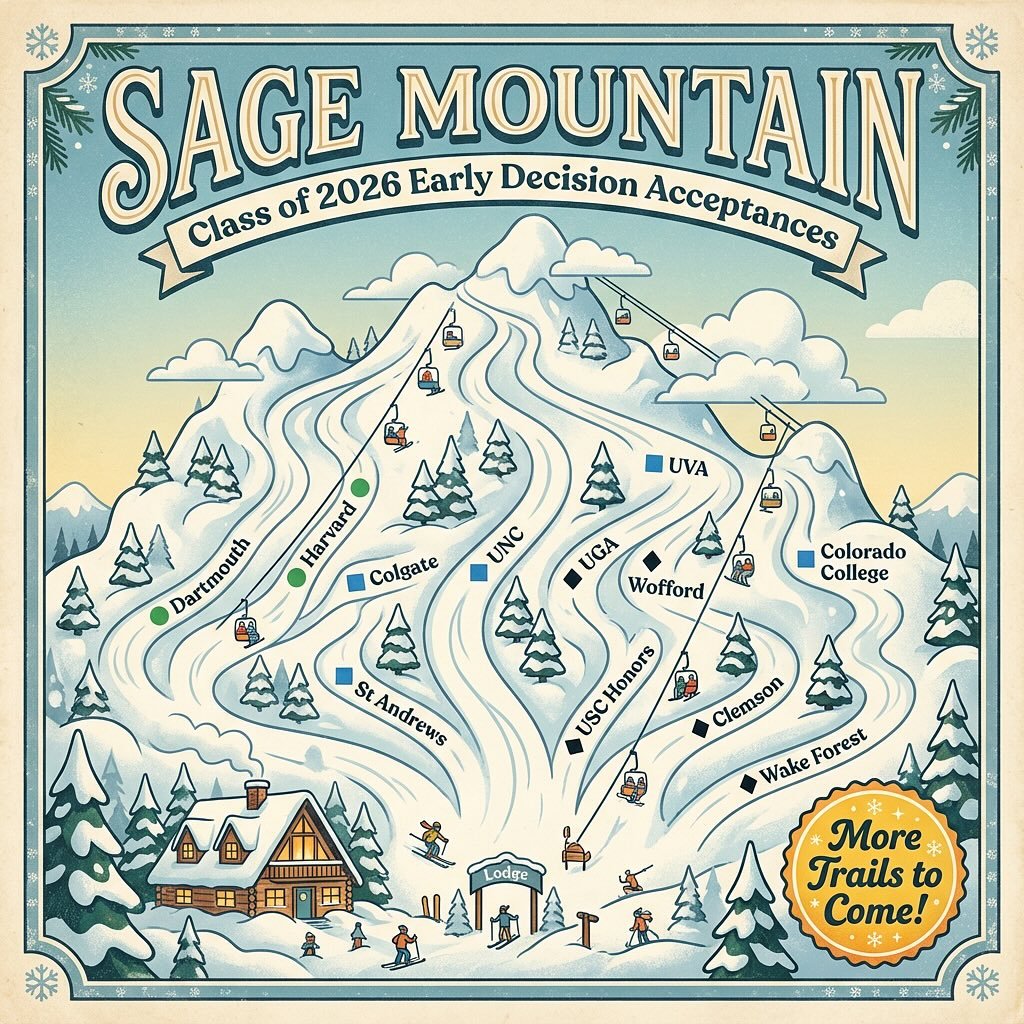

“Game on”: Why the Stakes are Rising for the Best Public Universities

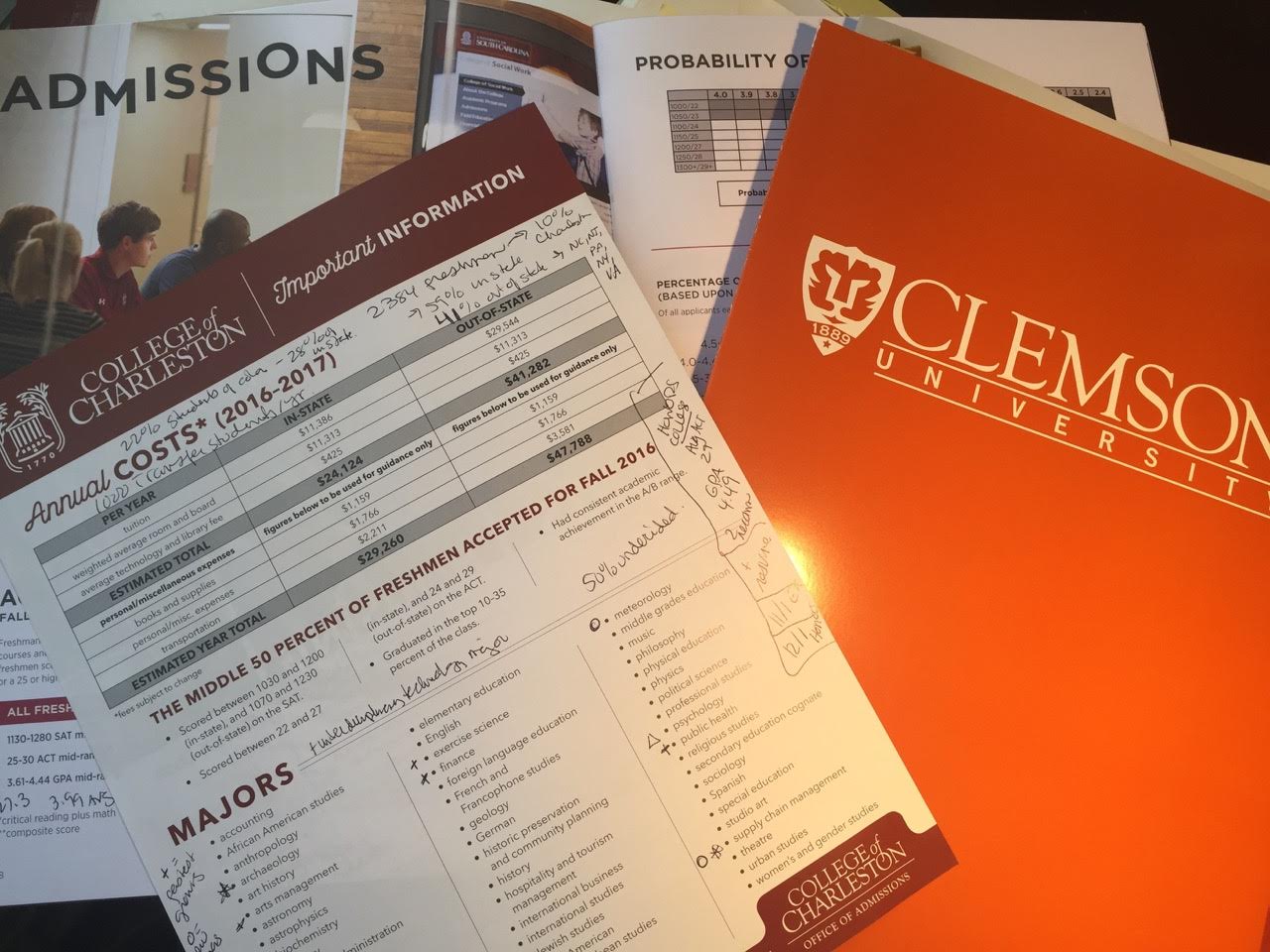

Not surprisingly, the competition for public college admissions is also on the rise. Clemson received a 6% increase in applications for 2016 admissions, the most applications ever received in one year. They now accept only one of every two applications and that is likely to get more competitive as their yield continues to increase. Clemson admissions had targeted a class of 2020 of about 3,550 freshman but they received 3,800 deposits and ended up enrolling 3,686 freshmen. The University of South Carolina average accepted student now has an ACT score of 27.3 (out of 36 possible and versus an average SC student ACT score of 18.5). College of Charleston out-of-state students now make up 41% of the entering freshman class.

Competition for the coveted honors college spots in SC is already in full swing. Of the 800 total honors spots for freshman students (in and out of state), the average ACT ranges from 29 at the College of Charleston to a 33 at Clemson with a weighted GPA of at least 4.5 to be competitive for an honors spot.

The stakes have never been so high for high school performance. It’s “Game on”!

College Sage is a Charleston based Independent Education Consulting Firm. Contact us for all your college counseling needs, including how to be smart about college costs. Learn more at thecollegesage.com .